With the end of cash payments on the horizon, it’s uncertain what the future has in store for cold, hard cash.

However, according to the 2021 Federal Reserve study, one thing is certain – with US consumers using non-cash payment methods for approximately 80% of all payments today (about 27% of which are made by credit cards), this cashless future is likely closer than we think.

Since cash is slowly but surely dying out, small business owners can make one of two choices – adapt to the changes and start accepting credit card payments or let their businesses be trampled by the march of time.

So, if you’re one of the former ones, we’ve created this short guide to help small-business owners like yourself to master credit card payments and transform their business together with the digital age.

How to collect credit card payments for your small business

There’s no shortage of reasons you’d want to start collecting credit card payments for your business (stronger security, enhanced efficiency, and convenience to name a few), but before you start making the first steps you’ll need to choose how and when to do it.

So, let’s check the most popular methods for accepting credit card payments and go through the strengths and weaknesses of each of them.

Use a credit card payment processor

Choosing the right credit card payment processor is critical for any business, but with so many providers that offer similar services out there how to know which one is right for you?

The simplest way to solve this dilemma is to go with the flow and choose the most popular ones such as PayPal – it provides a seamless checkout process, accepts over 100 currencies, works in most counties, offers superior flexibility and scalability for businesses, and is surprisingly simple to use.

In addition to PayPal, you should consider adding other superb credit card payment processors for small businesses like Stripe, Square, and Shopify – all of them come with unique sets of pros and cons.

For instance, while PayPal is a perfect fit for most businesses, it takes a small percentage of your sales as payment and the higher your sales, the more it takes. It also puts the customer first, which means it can take complete control over your account if the customer opens a dispute that can’t be easily resolved.

On the other hand, Stripe will give you more control, but it isn’t as user-friendly as PayPal and will require some technical know-how to be set up. Square is strong in terms of features but lacks in the stability department.

At the same time, Shopify is perfect for e-commerce stores but comes with hefty transition fees.

All in all, all of these payment processors come with pros and cons, so it’s critical to sort them out and choose the one that works best for your business.

Take in-person payments

Every transaction is, technically speaking, a peer-to-peer (P2P) transfer, but here we’re going to talk about in-person payments that are critical for all brick-and-mortar stores out there.

To make this type of transaction possible, you’ll need a steadfast point-of-sale (POS) system with a credit card reader.

While there are different types of POS systems on the market (cloud-based and on-site servers alike), with a credit card reader a customer must be on the spot to insert the card into the reader – that’s a swipe transaction.

The main advantage of this type of transaction is convenience, cost-effectiveness, and lower risk of identity theft and human error than with card-not-present (CNP) transactions.

Some of the most common disadvantages of using card readers include somewhat slow transactions and the need for upgrading to new card readers every so often.

Payments over the phone

To accept credit card payments via a phone call you’ll need a POS system that will allow you to enter card details manually – perhaps something like Square or Clover.

As your customer reads the credit card information, you’ll enter it manually into the POS system and conclude a payment – this is also referred to as a keyed-in or a card-not-present transaction.

Although these types of payments seem pretty similar to in-person payments on the surface, since the customer is not there during the transaction they require a higher level of security.

While payments over the phone feel personal and are a superb way to create an excellent customer experience and build long-term customer relationships, they will put you at higher risk of fraud. Plus, since credit card details and other critical data are entered manually, the chance of human error is significantly higher than with other methods.

Accept mobile payments

To accept mobile payments at your store, you’ll have to pick out a POS system that’s equipped with near-field communication (NFC) technology – these types of payments are often called contactless payments.

Once you get your mobile payments reader, you can start accepting mobile payments via mobile payment services such as Google Pay, Apple Pay, and Samsung Pay.

It’s much swifter than payments made by cash, physical credit cards, or cheques – all the seller has to do is ring up a purchase, wait for the green light to show up on the reader, and ask the customer to hold the phone over the reader to make a payment – it shouldn’t take more than a couple of seconds.

The downside of contactless payments is that they often come with limits (it’s €50 in most European countries), meaning you won’t be able to accept larger payments. Also, a contactless payment could be denied if the customer’s mobile device has a low battery charge.

Use a 3rd party software

Not all businesses require the complexity of a POS system and for most of them a 3rd party credit card payment app will do the trick – simply download the app on your smartphone and take credit card payments on the go.

Most payment processors also come with a seamless checkout experience (with multi-currency support, taxes, and receipts), inventory tracking, and a card reader. However, the best among them won’t stop at that.

For instance, with vcita you’ll get more than a payment processor – it’s also a full-blown, cloud-based CRM and business management solution created with small businesses in mind – Square Online and Shopify Payments are also worth checking out.

With this sort of solution, you’ll be able to manage all your payments from a single, user-friendly interface and accept payments through a myriad of 3rd party integration (such as PayPal, Stripe, Venmo, and so forth), but also take phone, email, and on-site payments.

The only notable drawback of using 3rd party software is higher transaction fees, but this varies from one provider to another and depends on the size of your business.

Open a merchant account

While the terms “merchant account provider” and “payment service provider” are often used interchangeably, they aren’t quite the same – however, to be fair, they perform similar sets of services.

With a merchant account provider, you can open an account (unsurprisingly called a merchant account) that will serve as a sort of temporary repository for all your payments and they will land there before being deposited into your regular bank account – some of the top providers are Stripe, National Processing, and Stax.

On-site, these providers also offer a POS system and check support, while online they provide chargeback support as well as processing a whole variety of online payments (credit/debit cards, e-wallets, mobile payments, and much more).

Having a merchant account allows businesses to receive the money for transactions right away rather than having to wait for customers to pay their credit card bills. On the downside, these accounts often come with a hefty price tag and a lengthy contract, which might drive away businesses on a tight budget.

While in the past business owners had to create a merchant account to accept credit card payments for their business, now you can opt for a payment service provider and skip a merchant account altogether.

Costs of accepting a credit card

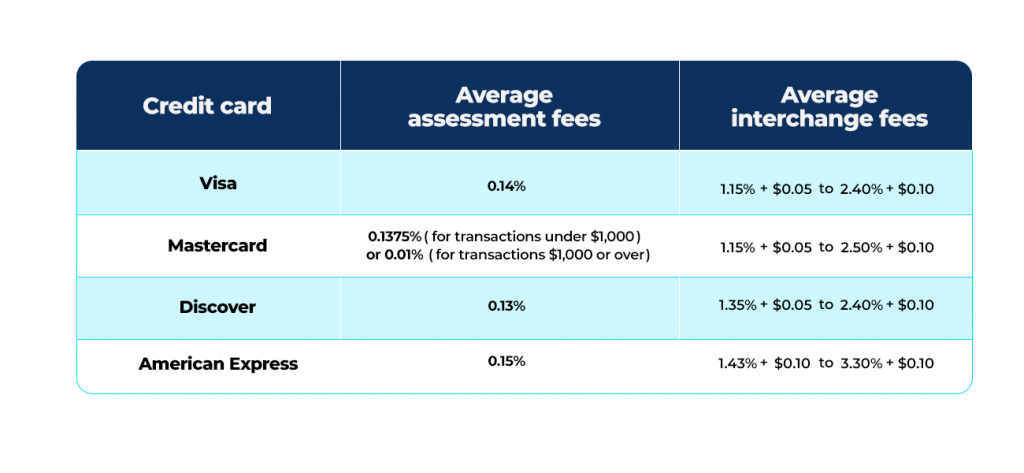

All credit card transactions come with fitting fees and there are three types of fees you’ll be paying each time a customer purchases your products or services with their credit card:

1. Interchange fee – charged by the bank you’re using;

2. Assessment fee – goes to the card’s payment network and is set for every year;

3. The markup fee – gets split among all the parties that are involved in processing your transactions.

To get a clearer picture of credit card processing costs, check out the table below:

Accepting credit cards is crucial to your business’ survival

Choosing to be a cash-only business can cost you a lot of business today and sabotage its survival in the days to come. So, waste no time and pick up a credit card payment processing system – but which one to choose?

Since there’s no one-size-fits-all sort of solution for small businesses, you’ll have to work out which option is the best for you and your business – just try to get a good rate and select a company that’ll supply you with all the support you’ll need to set your business up for long term success.