If there’s one thing that all small business owners can agree on, it’s this:

Late payments suck.

Because when a client is late paying you, you’re the one who ends up as a giant ball of stress despite doing nothing wrong.

And late payments are much more than just an inconvenience to you: they’re detrimental to your business.

Think about it. From trying to make income projections to paying your own bills, on-again-off-again payments from problem clients are a huge headache.

This is exactly why small businesses owners need a specific strategy for collecting payments quickly, efficiently and around the clock.

Below we’ve highlighted how to create a payment system that gets you paid on time without chasing clients down.

And with that, let’s dive in!

1. Make Your Payment Options More Flexible

We live in a day and age where customers expect to pay on their own terms, plain and simple.

And whether that means cash, credit or mobile payments, it’s our responsibility as business owners to meet that expectation.

For example, customer interest is on the rise for paying via smartphone despite less than 20% of businesses accepting mobile payments.

Bummer!

And so if the customer is always right, how can you do right by your customers?

In short? Expand your payment processing options. Rather than force your clients to think twice about handing over their hard-earned cash, businesses owners should make the process as painless as possible.

So when it comes to accepting payments, think “the more, the merrier.”

Credit? Check!

Online payments? Check!

Mobile wallets like PayPal and Stripe where people are spending billions of dollars per year? Double-check!

And of course, accepting cold hard cash is also fair game if you’re a brick-and-mortar business.

The more convenient it is for clients to pay you via the payment method of their choice, the better. Through a multi-channel approach to payments, you guarantee that your business jives with whatever your clients want.

2. Let Clients Pay from Anywhere and Everywhere

Think about how much running around you do on a day-to-day basis.

A meeting here. An appointment there. Picking the kids up, dropping the kids off.

Here’s some food for thought: there’s a good chance that your clients are equally as busy.

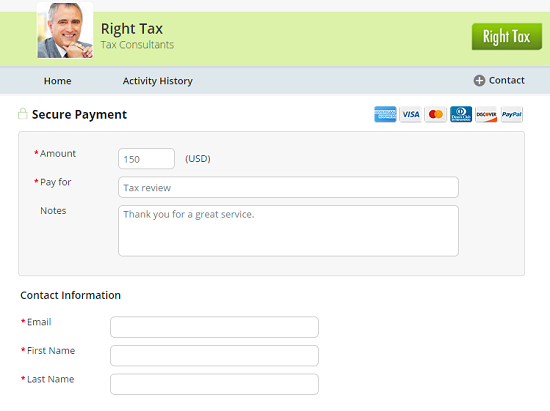

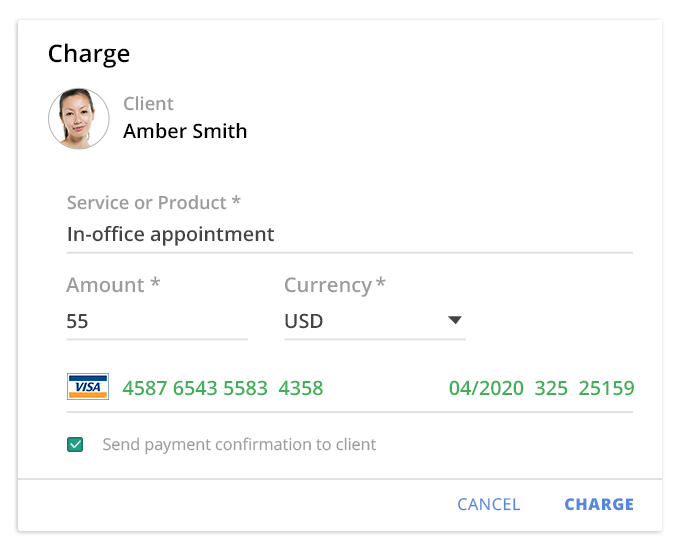

That’s why accepting payments on-the-go is a total game-changer for small business owners today. Having a virtual payment terminal can boost your income as you can charge clients on the spot virtually anywhere.

In short, a virtual payment terminal is a gateway where small businesses can accept credit card payments online – all you need is an Internet connection and a smartphone/laptop to get started. Think of it as your business’ personal credit card machine (without all the wires, of course).

The upside of having a payment terminal if that you can instantly charge clients from anywhere and everywhere.

And because you can accept payments without the cardholder present, every interaction with a client means an opportunity to get paid.

Rather than play the waiting game involved with back-and-forth invoicing, you can instantly handle payments via your laptop or smartphone without having to worry about any extra equipment.

No more lag time, no more phone tag with clients.

This is a nice bonus for both you and your clients as you again make your payment options even more flexible in the process.

3. Collect Payments Upfront

This one’s pretty straightforward but often overlooked by small business owners.

When you collect payments upfront, there’s no second-guessing whether or not you’re going to see your cash.

If you’re timid about this sort of policy, we don’t blame you!

However, there are a few reasons why requiring payment upfront flat out makes sense.

For starters, it shows that you mean business. Upfront payments imply that you’re confident in your services and can produce results on behalf of your clients.

Also, consider that there are tons of businesses out there that require upfront payments or deposits (think: just about any home contractor or auto work). Sometimes if you want something, you just have to ask.

And most importantly, getting paid upfront keeps you from second-guessing your schedule.

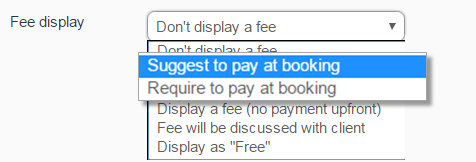

At vcita, we empower all of our users to suggest or require payment during the appointment booking process.

By knowing that you have appointments booked and paid in advance, it’s so much easier to predict your own income and what else you can fit on your calendar. This also helps you avoid no-shows, too.

Nice, right?

4. Automate Your Invoicing and Payment Reminders

Small business owners should strive to be as efficient as possible.

Manually tracking down each and every missing payment and sending a barrage of emails is pretty much the opposite of efficiency.

In fact, it’s a recipe for stress and lost time.

Instead, businesses should take advantage of automation by setting up their own ecosystem of invoices and reminders.

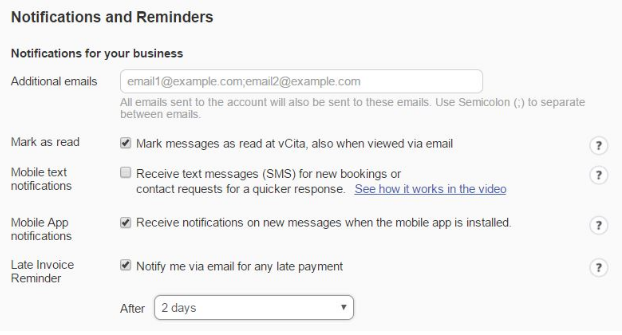

When accepting payments through vcita, you can automate notifications via email and SMS to ensure that your invoices are can’t-miss.

Putting these processes on autopilot saves you time and keeps you from second-guessing whether or not a client knows it’s time to pay up.

And remember: time is money. Every minute you spend tracking your invoices is time you’re not spending marketing your services or scoring new clients.

5. Create a Late Fee Policy

Finally, having an explicit late fee policy can act as an effective deterrent for untimely payments.

Many businesses tack on a certain percentage (10%, for example) when payments aren’t made on time.

Here’s some sample late-fee language that you can implement into your payment terms:

“Accounts not paid within terms are subject to a 10 % monthly finance charge.”

Of course, you shouldn’t make this policy as a sort of “gotcha” to your clients.

You should explicitly state any late fee policies throughout your site and on any pages where your client is booking an appointment. While late fee policies are indeed effective, they need to be loud and clear to manage your clients’ expectations.

In short, such a policy does double duty of again showing that you mean business and encouraging clients not to sleep on your reminders.

Think that such a policy is a bit harsh? Afraid that it might turn some clients off?

Don’t!

As a small business owner, getting paid should not be seen as any sort of inconvenience to your clients. Whether you take the good cop or bad cop approach is totally up to you as long as you get paid at the end of the day.

And with that, we wrap up our list!

What’s Your System for Getting Paid On Time?

If you’re a business owner today, getting paid on time should be an expectation rather than an exception to the rule.

And so instead of fighting tooth and nail for payments, strive to set your business up in a way that payments are coming to you quickly and consistently from clients.

With these tips and the help of platforms like vcita, you can create a seamless system that ensures you get paid on time, every time.