Small business owners juggle many responsibilities. According to the U.S. Small Business Administration, there are over 30 million in the United States alone. Whether you are self-employed, have a startup, run family business or a franchise, it can be a balancing act when creating a budget for your company.

By making and managing a business budget, you will be able to set clear goals and allocate resources so that you can successfully generate a profit. What’s more, it can help you control your spending and forecast the money coming in.

You may have to balance between slow and peak seasons if your company is in demand during certain times of the year. You may fall into this category if you are a boutique store owner, a wedding photographer, or if you own a fitness facility. Staying on top of your budget is a great way to keep on track of hitting your targets.

What you need to get started

It can be intimidating to start a budget from scratch. Fortunately, all you need is a simple spreadsheet. The good news is that we have simplified the process for you by creating this vcita small business budget template that you can use. You can download the template and follow along with the instructions we have outlined for you.

You can tailor the template to your specific industry and your unique business needs. By taking the time to research your industry’s standard sales revenues, average expenses and profit margins, you have a baseline of what your spreadsheet should look like.

Not sure how to set your goals? Here are some tips on how to create goals that will work for you. Over a period of time, when you collect more financial data you will be able to be more precise in predicting your company’s figures. It is also beneficial to gather other financial documents including your balance sheet, cash flow statement and income statement to assist you in filling out your budget.

Step 1: Add all revenue streams

The income sources of your organization will come from the ongoing operations and activities.

Does your company offer products, services or both? You may only have one income stream or multiple sources. These operating revenues are based on the day-to-day activities that generate income. There are many ways to boost your income in order to add more revenue streams.

This is where you can refer to your income statement and balance sheet to find your sources of revenue. You may also have non-operating revenues which may include interest made on a business savings account, dividends or capital gains earned from investments. These types of revenues are not related to your business’ core operations.

Determine the sums of your operating revenues and your non-operating revenues. You will then add those two figures together to obtain your total revenues. You can now proceed to the next stage of calculating your expenses.

Step 2: Tally your fixed expenses

Fixed expenses are the recurring costs that stay the same from month-to-month. They are essential to running your business and they must be paid no matter how many products or services you sell. These types of costs may include rent, insurance, telephone bills, web hosting and domain charges and payroll.

Managing payroll efficiently is crucial for small business owners wanting to optimize their operations and ensure employee satisfaction. By partnering with a specialized provider like OnPay, businesses can streamline their payroll processes, navigate the complexities of tax regulations, and offer benefits that help attract top-tier talent

Keep in mind that fixed expenses can vary from industry to industry. You may be able to reduce your fixed cost by switching to another provider that gives you a better offer or moving your workplace to a more affordable location, for example. Record all your fixed costs and add them up. You can now move onto the next step.

Step 3: Determine variable expenses

Unlike a fixed expense, a variable cost can fluctuate from month to month. Variable costs tend to go up when a company produces more goods or services. If a company winds down production, the variable costs should reflect that.

Types of variable expenses may include raw materials, shipping costs, marketing expenses, along with bank fees of your business account.

Over time as your company increases production, you may be able to negotiate with your suppliers to lower your per-unit costs. If you are service-based, such as a consultant, you may incur travel costs to visit your clients.

Download and use our vcita Small Business Budget Template for free!

Step 4: Figure out one-time expenses

Occasionally you may need to make sizable corporate expenses that are not part of your business’ ongoing operations. Typically this will happen when you need to invest in capital expenditures such as office equipment, furniture, purchase of real estate, a company vehicle, legal fees, damage costs, or restructuring costs. It is important to account for these expenses to ensure that you have enough funds to cover these costs.

Sometimes these non-recurring expenses can skew a company’s profitability positively or negatively. By having these items listed out its own section, it will help you determine what is a consistent expense versus a one-off expense. It is prudent to research what these unusual costs are as they can vary widely and can depend on which vendor you go with. Being armed with this knowledge will better prepare you for these upcoming payments as well as to negotiate with your suppliers to get the best deals.

Step 5: Calculate your net income

The final step is to determine whether you have a profit or loss. There are two parts to this:

The first part is calculate your total expenses by adding:

- Total fixed expenses

- Total variable expenses

- Total one-time expenses

The second part is to take total revenues and subtract total expenses to determine your net income (revenue – expenses = net income/profit).

Ideally you will want to be generating a healthy profit that is aligned with your projections. Furthermore, you will want to compare your year-to-year profits to see that it is steadily growing and that you are successfully meeting your goals.

If you are in the early stages of running your company, it may take several years to turn a profit as you may be investing a lot of time and capital into your firm to get it up and running. You may have to come up with creative ideas to expand your income streams and reduce your expenses, so that you can become profitable.

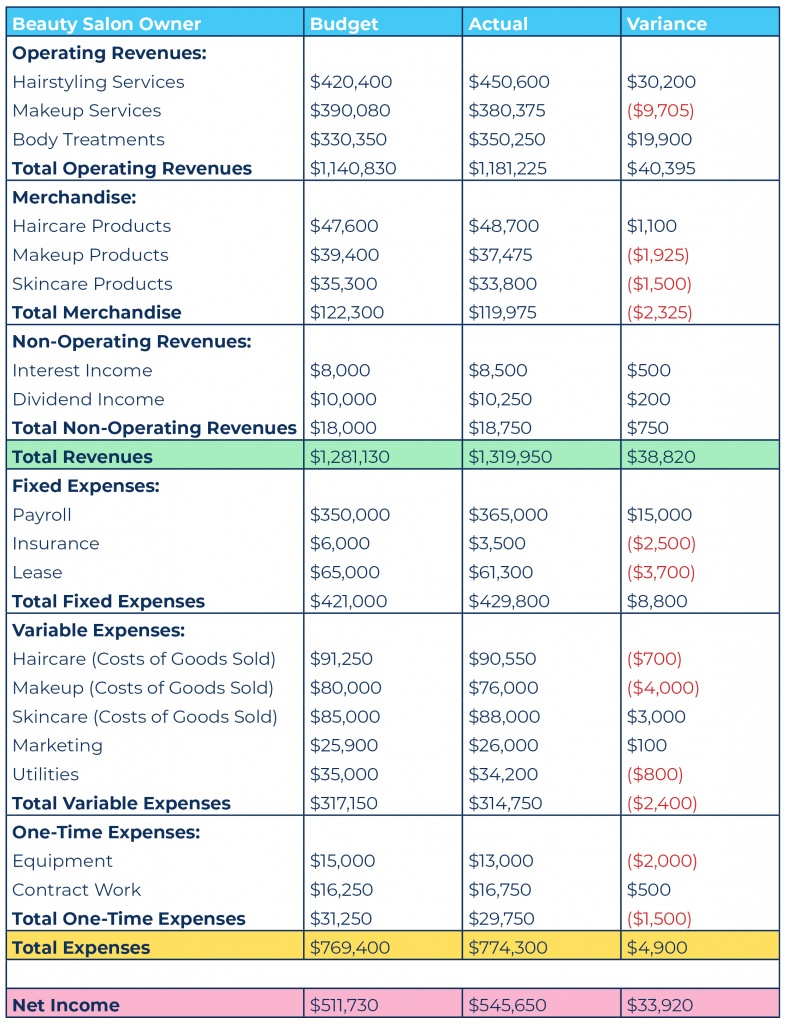

Beauty Salon Owner Budget

Here is an example of a simplified budget of a salon owner. You can see that this establishment was not only able to generate a profit but also exceeded their forecasted total revenues by $38,820 which they were able to accomplish by offering special promotions and packages throughout the year.

Overall, they went slightly above their allocated expenses and can improve their payroll costs. The business owner can examine the additional staff needed which was not accounted for during busy weekends.

An area for improvement is to discover new ways to increase their makeup services by targeting wedding clientele. By making this financial blueprint, the beauty salon owner was able to identify what strategies worked well and what areas they could enhance to make their business more efficient and manage their finances better.

Maintaining and growing your business

Now that you have completed your budget for the year, you can clearly see if your company was profitable within the past year. On top of that, it will show how successful you (and your team, if you have one) were in following the forecasted numbers. Were your expectations aligned with the actual outcome? If there was a big difference, then you will want to identify the gaps and how you can adjust your goals going forward.

If you have team members, you can work with them to determine how you can boost your revenues and reduce your expenses. You may decide where you need to allocate more resources or where you need to cut back. By taking these steps, you can grow your company and boost your profits for many years to come.