Did you know that aside from having your own personal credit score, your business gets one too? Whether you’re just starting out or are already running your business, establishing a business credit score might not be one of your top priorities, which is understandable considering the amount of work you already have on your plate.

However, you don’t want to be one of the many small business owners that are reminded of their business credit score when it’s too late and you’ve been denied a loan at the bank.

Establishing business credit, and early on, will help you gain access to better funding opportunities, be it loans, investing, or insurance and more, which can help you save or expand your business in your time of need.

What is a business credit score?

Your business credit score gives creditors and lenders an indication of how reliable of a lending candidate you are. When a lender or creditor considers offering funding to your business, they look to minimize the risk they will incur. They see it as: higher your business credit score, the higher your chances are of paying off debts, making it easier for you to obtain a credit card, loan or line of credit for your business.

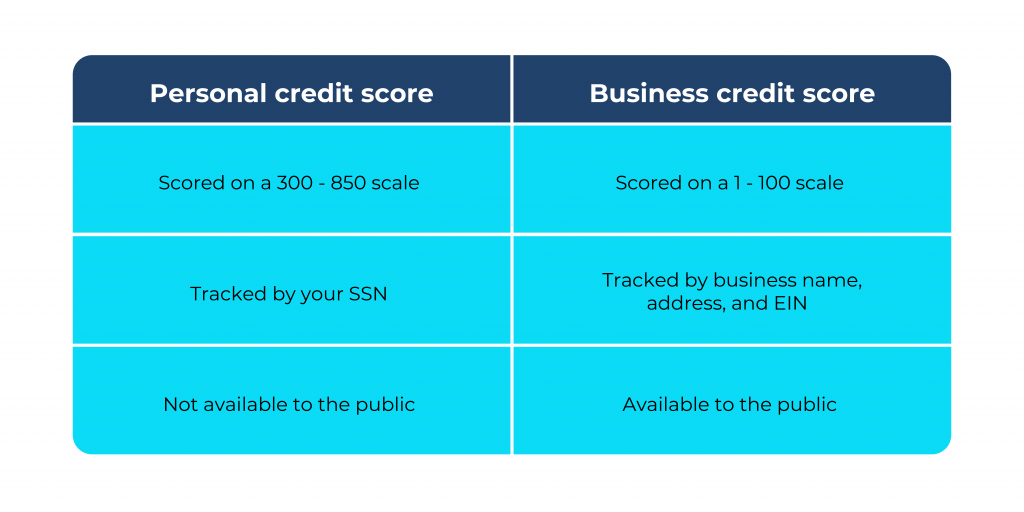

There are a few differences between your business credit score and your personal credit score:

There are 3 major credit reporting agencies that track your business credit score, and you should check on whether you have to apply to them in order to be tracked:

These reporting agencies track your business financial records and history and use it to score your business on a scale of 1 to 100, this is your business credit score.

How is a business credit score calculated?

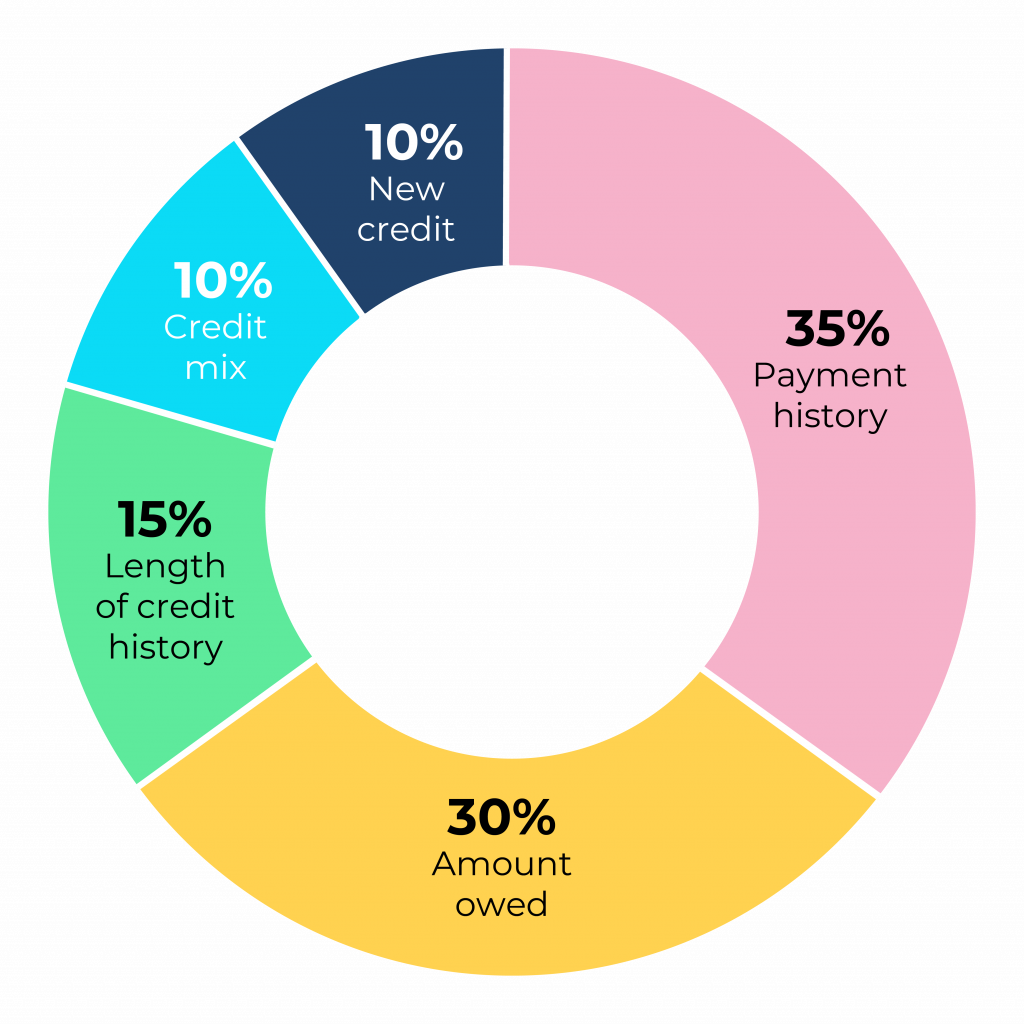

There are 5 factors that play into account in your business credit score:

- Your payment history: This accounts for 35% of your credit score calculation. Your payment history accounts for your past payments. Were they made on time? If not, how late were they? These are the things the reporting agencies are looking for.

- Your credit utilization: At 30%, your credit utilization is an important factor of your credit score. This number is calculated by the amount of credit you use in comparison to what’s offered to you. The experts at Experian recommend that you stay below the 30% credit utilization ratio.

- How long you’ve been accruing credit: This accounts for 15% and is determined by how long you’ve been borrowing and paying back funds.

- Any new credit you ask for: Although just 10%, this number represents how many times you’ve inquired about or asked for new credit opportunities or loans. Reporting agencies take into account how many times you’ve asked to review your credit report as each time indicates to them that you are seeking funding.

- Your credit mix: 10% of your credit score is dependent on the various types of credit that make up your credit history such as credit cards, mortgages, bills, lines of credit, etc.

What’s a “good” business credit score?

The answer to this question varies depending on the lender and even the credit reporting agencies. The idea overall is to get as close to the 100 as possible however, it seems that 75 is an agreed upon “good” credit score.

Why does a good credit score matter for your business?

Because you don’t get directly penalized for having a low credit score, it can be easy to prioritize a good credit score low on your list and forget about working on it. However, the benefits to having a good business credit score come in handy in more ways than one.

It can save you in an emergency

Since having a higher credit score indicates that you are a reliable business, applying for loans when you need them the most would be a lot easier than if you had a lower credit score. If you don’t have a safety net for your business in the form of a business emergency fund or money put aside for a rainy day, having a good business credit score could potentially save your business.

It’s a good look for investors

When fundraising for your business, it’s a good look to show investors that you have taken the time to improve your business credit score. They’ll see you as a reliable person to invest in and your business will look like a more promising prospect for their investment.

It can help your business grow

In order to expand their business, many small business owners look to secure a business loan that will help them pay for equipment, salaries, new locations and more. The chances of you receiving a business loan with lower interest rates depends on your business credit score.

How to build up your business credit score

Now that you’ve understood the absolute importance of having a business credit score, it’s time to be proactive and work on getting your business credit score closer to that 100.

Make sure your business is registered

The first step you want to take to make sure your business even gets a credit score is to register your business with one of the credit reporting agencies mentioned above. Once you have an employee identification number (or EIN) you can go ahead and register your business.

Get a business credit card, and use it

Once your business is registered, you’ll want to start establishing credit. You can do this by taking out a business credit card and beginning to use it. Paying off your credit card each month will get reported to the credit reporting agencies and therefore improve your credit score. Just don’t go on a spending spree and spend money that you can’t pay back later.

Make payments on time

Paying your credit cards and loans on time each month will definitely help you get a better credit score for your business. Since your payment history accounts for 35% of your credit score, you want to make sure you aren’t missing out on any payments.

Make sure your vendors are reporting your payments

The main way to improve your credit score is to make sure payments you make are reported to the business credit agencies. If you’re not sure, or want to see if it’s an option, ask your vendor to report your payments. If they’re not willing to, it might be time to find a different vendor.

Check your credit report regularly

Though you may have to pay to receive your credit report from one of the credit agencies, it’s worth checking your credit report at least once a year. But when we say check it, we mean really check it. Credit repair software can greatly facilitate this process, allowing for more frequent and thorough checks. Check for errors and make sure nothing needs to be corrected, there are sometimes mistakes in reporting which are directly reflected in your credit score, and you don’t want that!

Lower your credit utilization

As mentioned above, your credit utilization ratio is how much of your available credit you are actually using. Say, for example, you have a credit card with a limit of $10,000 and you spend $3,000, your ratio is at 30% credit utilization, which is where the experts say you want to be. If you’re spending more than that, it could really hurt your credit score. Take a look at your expenses and see where you can either move or reduce some of them to get your credit utilization ratio as close to the 30% (or below) as possible.

Get your business a healthy credit score

Though there’s a lot on your plate when running your business, establishing a good credit score should be there among the top priorities. By consistently paying off your debt on time, working with vendors that report your payments, regularly checking your credit report and keeping a low credit utilization ratio you can secure your business better funding opportunities in the future. Work on it now and pick the fruits of your labor later, when it counts the most.